This article was originally published in The Notebook. In August 2020, The Notebook became Chalkbeat Philadelphia.

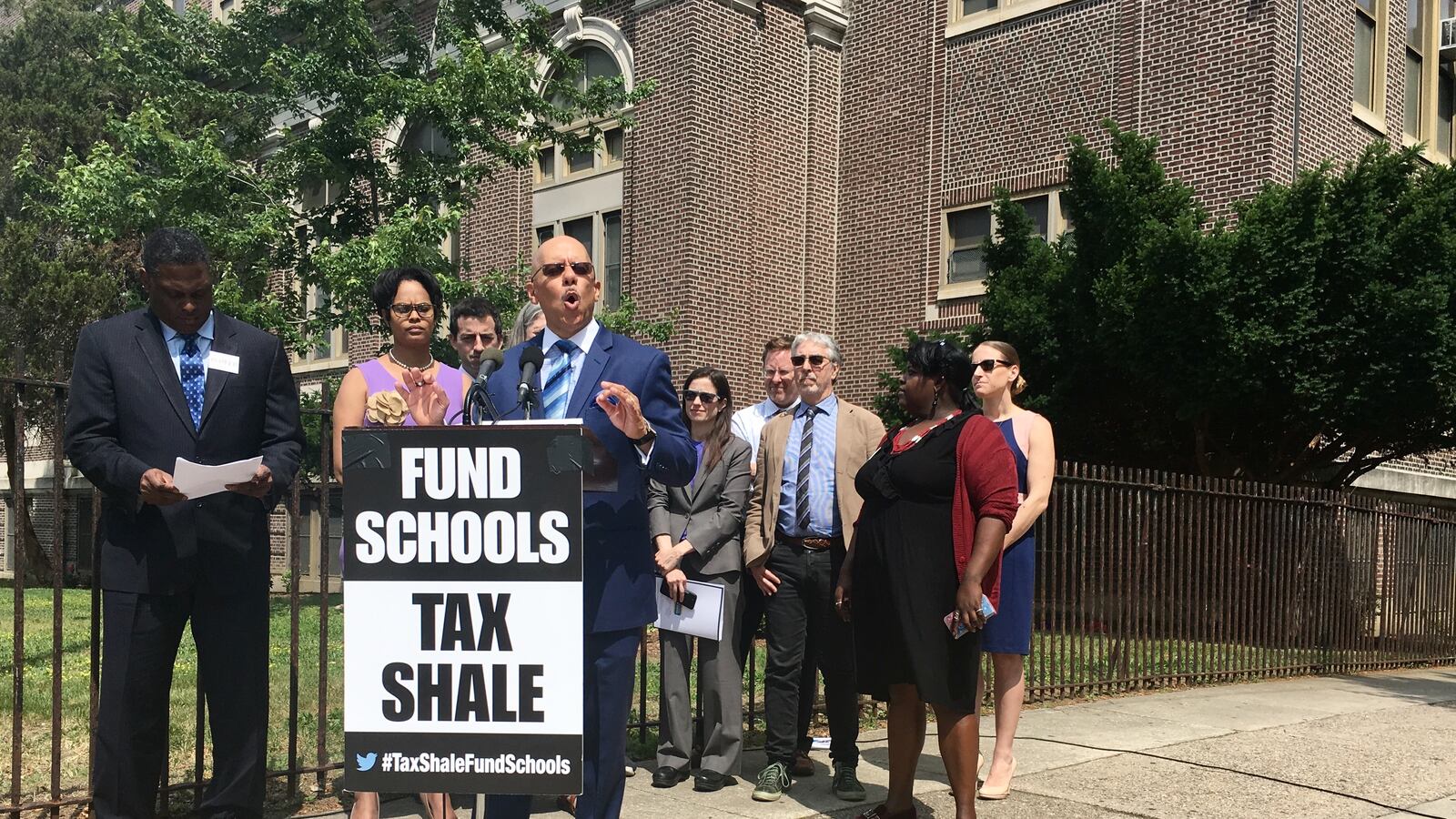

State Sen. Vincent Hughes chose Cassidy Elementary in Philadelphia as the spot to unveil a new bill Thursday that would bring money to underfunded schools by taxing natural gas production.

Hughes, a Democrat representing parts of Philadelphia and Montgomery Counties, was returning a favor of sorts. Cassidy students visited the state Capitol in Harrisburg on Tuesday to urge legislators to address inequity among school districts across the state.

Hughes’ proposed legislation would provide money to repair and upgrade schools and ensure an equitable public education for students statewide.

Among several people at the school to support Hughes were State Rep. Morgan Cephas, a fellow Democrat from Philadelphia; Jerry Roseman, acting director of occupational and environmental health and safety for the Philadelphia Federation of Teachers; the Rev. Gregory Holston, executive director of POWER; and Joan Duvall-Flynn, president of the Pennsylvania NAACP.

Standing in front of the school, Hughes was just minutes away from Lower Merion, one of the wealthiest school districts in the state. The senator said schools like Lower Merion’s don’t suffer from the same problems as those in underfunded districts.

“There are two separate and distinct education systems in this state, and they are unequal,” Hughes said. “They are unequal because of race, and they are unequal because of income.”

Senate Bill 777, or the Emergency Equal Education Plan, as Hughes calls it, would cost $8.25 billion and bring underfunded districts to equitable standards and more investment in academics.

Pennsylvania ranks as having the worst funding disparity between rich and poor district in the country, $5 billion would be allocated for “repairing, rebuilding, and revitalizing” school districts that have been “locked out of the funding.”

The remaining $3.25 billion would be disbursed over five years — $650 million per year, with $400 million going to the fair-funding formula and $250 million going to academic programs and efforts. These include intensive grade-level reading and math instruction, class-size reduction, community schools, full-day kindergarten, college prep and AP classes, and career and technical courses.

“We’re going for what is necessary to get to the equality that these children, all of these children, of the Commonwealth of Pennsylvania deserve to have,” Hughes said.

In addition to existing revenue sources, the money to fund the bill would come from taxing natural gas production.

“One of the key elements of addressing injustice is adequate and fair funding,” said Mary Filardo, executive director of the 21st Century School Fund, an advocacy organization for healthy, safe and adequate learning environments that supports the senator’s bill.

The 23-year-old nonprofit released a report that provides a state and national analysis of 20 years of maintenance and operations spending and capital construction investments on public school facilities. Hughes used that research when creating his bill.

“Using a tax on natural gas for infrastructure is spot on,” said Filardo.

Despite numerous previous attempts and the fact that Pennsylvania is one of the country’s largest producers of natural gas, it is the only state that doesn’t tax its producers for their extractions.

Since the natural gas boom began in the state, politicians from both parties have tried to raise revenue through a tax on shale gas production, to no avail. Gov. Wolf is now proposing an extraction tax of 6.5 percent.

Besides the legislative pushback, natural gas production in the state is slowing down, and the industry is under fire from environmentalists who see fracking, the process used to produce natural gas, as a threat to local water supplies.

Nevertheless, Hughes wants to use the tax to fund the bill and is confident that the industry will remain a sustainable revenue source.

A report released in April by the Pennsylvania Independent Fiscal Office, which provides revenue projections for state budgeting, estimates that a 6.5 percent tax would bring in $349 million in fiscal year 2017-18, increase by more than double the next year, and continue to rise to $1.15 billion in FY 2020-21.

Hughes said it’s time for natural gas producers to “pay your fair share” and “contribute to the Commonwealth,” and do so with a purpose.

“Don’t let it go into the general fund to be spent on God knows what,” he said. “Target your investment, your contribution, to a community of schools, urban and rural, all across this state that deserves the investment.”

No students were available for comment, but Hughes read copies of letters that students wrote to him last week asking for fair funding and better conditions in their school. Many of the students said the school was always dirty and felt like a prison.

“If you can’t take the science, if you can’t take the data, if you can’t take the research, if you can’t take the moral argument, at the very least take the message from the students,” Hughes said.

He will introduce the legislation next week.